Govt Agreed on TDS with Gaming Sector, GST Council Planned

02 Apr 2023

Gamers and Businesses will not be Swung between Tax Requirements

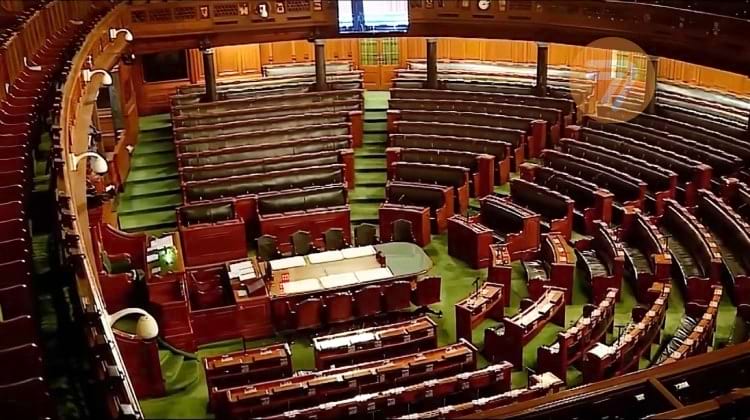

The Union Government has listened to the concerns of the Indian online gaming industry, and on March 24, the Finance Bill 2023 was adopted by the Lok Sabha with the corresponding amendments.

Just like the industry requested, the new regime for TDS (Tax Deducted at Source) over winnings from online gaming will become applicable from April 1 instead of July 1, 2023 and will spare gaming businesses and gamers lots of trouble.

The originally proposed draft of the Finance Bill introduced a new section 194BA to the Income Tax Act specifically dealing with TDS on winnings from online games, setting them aside from gambling and betting.

At the same time, the previously existing Section 194B was updated to cover, starting from April 1, 2023, all winnings “from gambling or betting of any form or nature whatsoever.” The amendments also clarified that the ₹10,000 threshold below which TDS is not applicable was valid for the aggregate amount of gambling and betting winning over the financial year, and not for separate withdrawals.

The new Section 194BA did not mention any TDS-free threshold but specified that TDS was applicable on net winnings. I.e., the aggregate amount of winnings from online games from the whole financial year. Minus all entry fees paid for the period.

The Problem with July 1

The practical problem with Section 194BA lay with the date it was intended to come into force – July 1, 2023. This implied that businesses and gamers would have to comply with two major changes. These changes in regulatory requirements being made just three months apart from each other.

This shifting burden would not only drain small companies out of resources but also create ambiguity and have considerable potential for misinterpretation when reporting the financial year.

India’s online gaming industry bodies were quick to react and sent a joint letter to the Central Board of Direct Taxes (CBDT) urging the effective date of the new Section 194BA to be moved to April 1, or, if that was infeasible, the amendments to the old Section 194B to come into force on July 1 together with 194BA.

Reactions from the Industry

After the Finance Bill 2023 answered the sector’s concerns, industry bodies representatives voiced their appreciation.

“We are grateful to the Government for accepting the industry’s appeal & ensuring a smooth transition to the new TDS regime for Online Gaming in the Finance Bill 2023.” The Federation of Indian Fantasy Sports (FIFS) Director General Joy Bhattacharjya is quoted.

“We also look forward to engaging with the Government on the rules for computation of net winnings and are hopeful that industry inputs will be given a favorable consideration,” he added.

Still, several gaming company CEOs expressed concerns. The concerns were that the removal of the ₹10,000 threshold would deter a lot of gamers. Specifically gamers who play with small amounts.

Update: CBDT Issues Guidelines on How to Calculate TDS

On May 22, 2023, the Central Board of Direct Taxes (CBDT) issued guidelines (Circular No. 5 of 2023). These guidelines are clarifying how to treat winnings from online games and how to calculate TDS.

The circular is answering a number of technical questions. Such as how are multiple accounts of one user at one or more platforms to be treated. As well as whether deposits made of loaded amounts are taxable. Also how bonuses and other incentives are to be calculated. Finally, at what point an amount should be considered withdrawn. And other issues.

TDS doesn’t need to be deducted from withdrawals containing net winnings under ₹100 per month. But tax obligation is to be balanced at the end of the financial year.

The GST Uncertainty might also Get Resolved Soon

There is one other major issue of tax compliance uncertainty for the Indian online gaming industry. How will GST be applied? This issue might soon be resolved. According to informed sources, the next meeting of the GST council is likely to be held in June. And the GoM report on gaming will likely be taken up for discussion.

“We expect the next meeting of the GST Council to be held in June when the report of the Group of Ministers on GST on online gaming, horse racing, and casinos will also be taken up for discussion and hopefully for approval,” the sources have said.