SevenJackpots’ Analytics Data Revealed

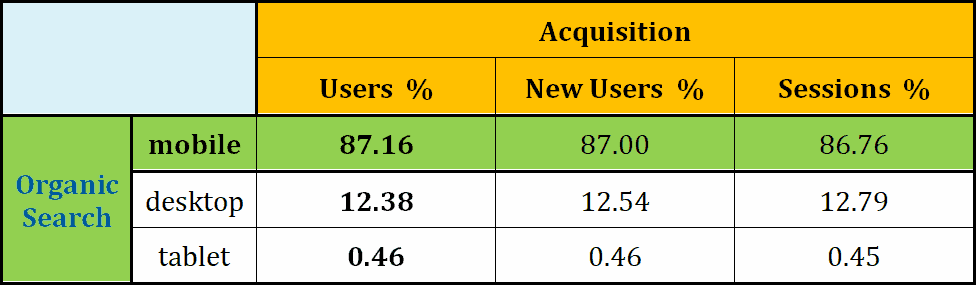

In this research paper, we have analysed the aggregate (and therefore anonymous) data for roughly 78 thousand registered users in the 15 months up to mid-2021. Organic player traffic is measured by visits, sessions, clicks, and bounce rates and shows that handheld devices approach a 90% share, at par or above similar global trends.

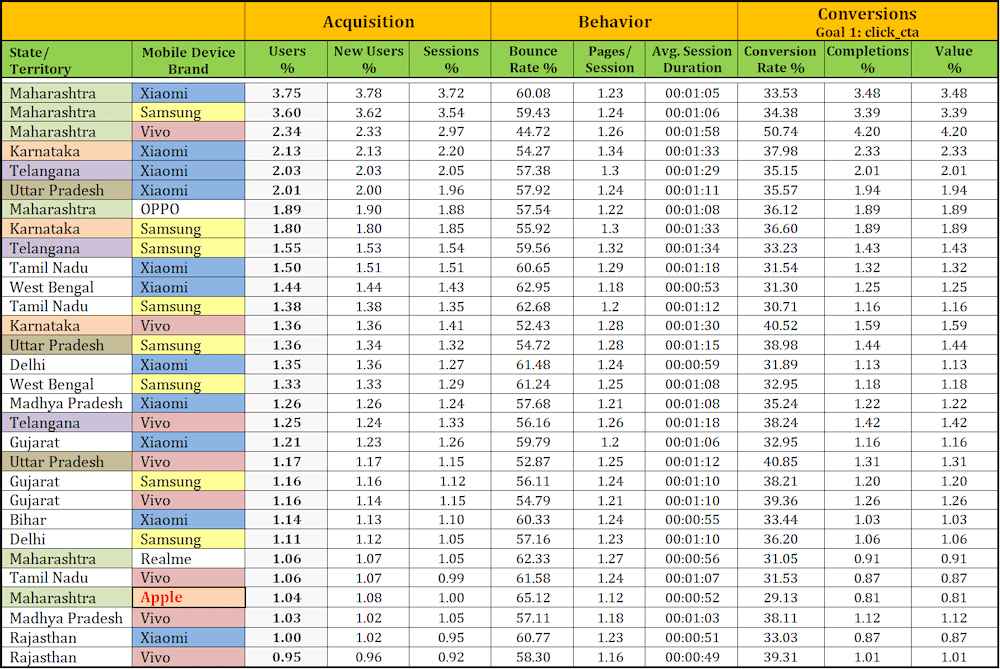

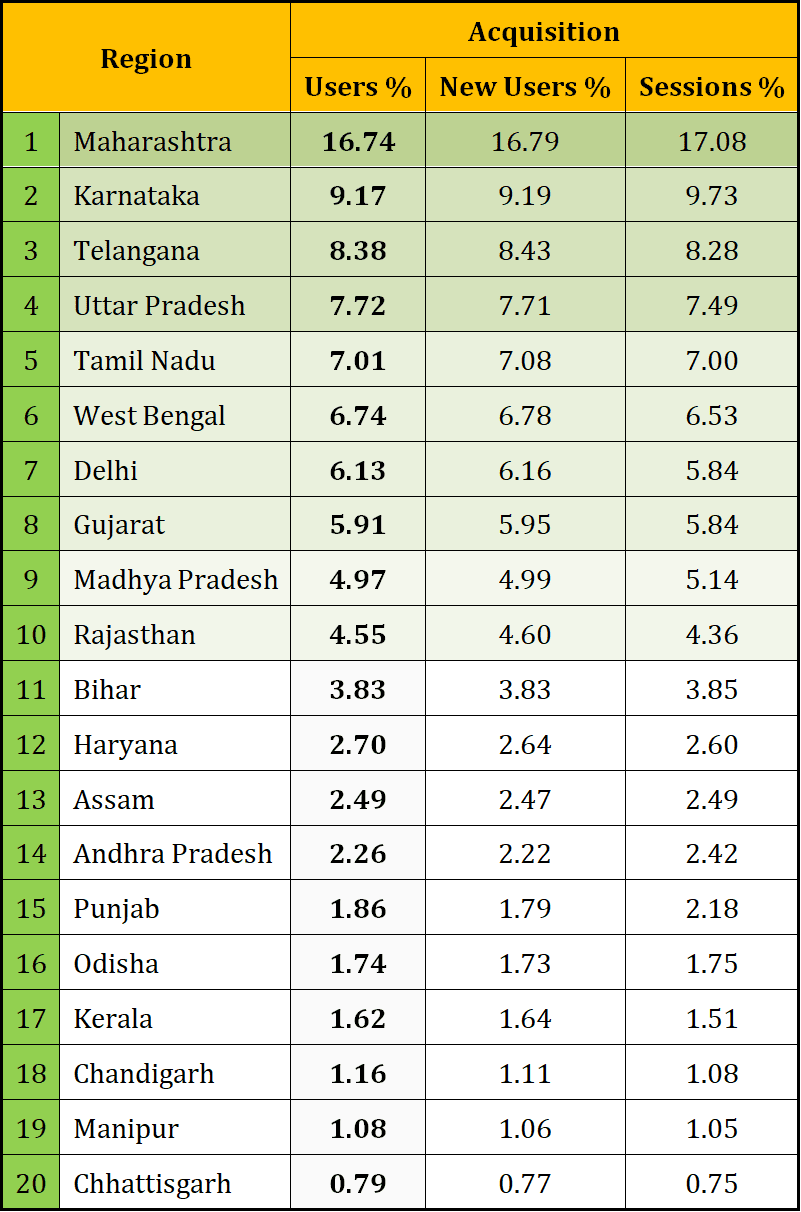

The user acquisition split by state of origin (see below) shows that Maharashtra dominates the gambling scene (with 16.74% of all players). It is followed by Karnataka (9.17%) and Telangana (8.38%), with the Top 5 list completed by Uttar Pradesh and Tamil Nadu.

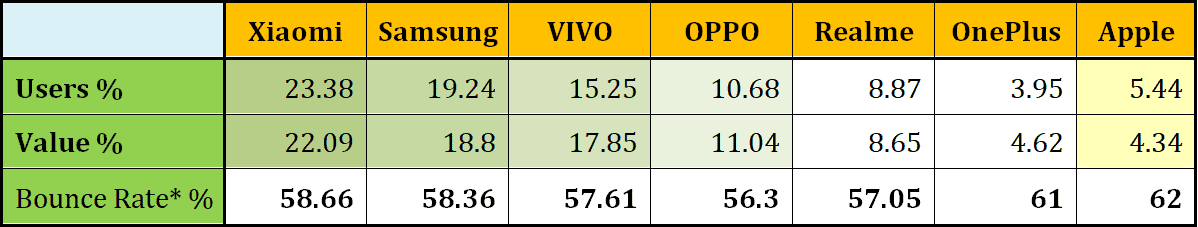

As we can see, Chinese-origin brands dominate the scene, with Samsung also holding a considerable market share. Apple appears way down the table with a modest market share. Overall, the top 6 Android phones combine for 89% of all brands used to access SevenJackpots.

The total organic acquisition shares by top brand devices are presented below. These conclusions are objective and concrete enough, but they still need to find substantial outside backing going forward.

Based on our primary data, 7JP users most commonly have a Xiaomi (23.38%), ahead of Samsung (19.24%) and Vivo (15.25%) a little further behind. Oppo and Realme gravitate around the 10% market share. OnePlus confirms its status as a premium smartphone brand, rivalling Apple in the segment.

The top 5 brands (six, if ranked by player value) all rely on Android as an OS. These six combines for 89% of all brands used. Interestingly, the absence of full Google services compatibility pushes one of the global leaders, Huawei, way down the rankings with only 2.14%. Political and trade wars inevitably affect its competitiveness in the Indian market.

Why Android Holds a Commanding Market Share in India

India is already the largest mobile gaming market with 810 million mobile internet users and an estimated 435 million online players. Desi publishing studios (reported as 5000 and counting) made 4% of game apps on Google Play available globally. However, India is responsible for 17% of game app downloads (an average of 800 million monthly).

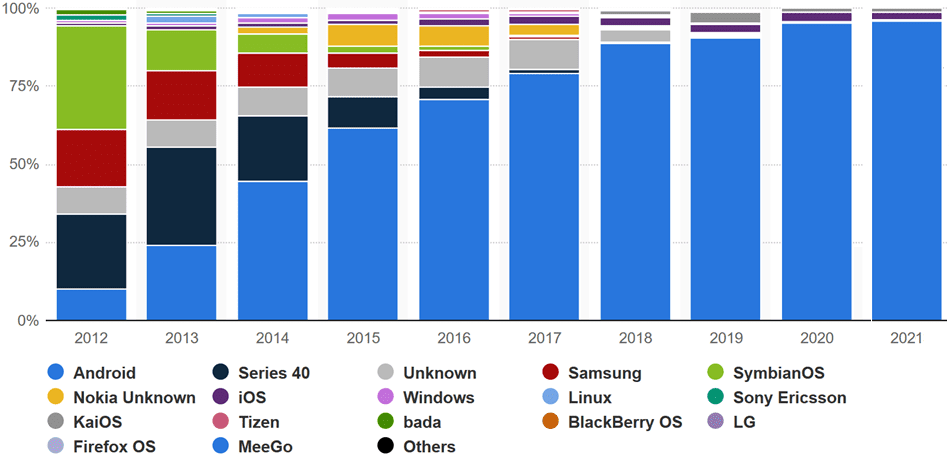

In May 2022, Android held a 95.1% market share among mobile devices in India. iOS was a distant second with 3.88%, despite a good sales performance over the past year. Android went from a mere 10% in 2012 to above 60% in just four years.

Market dynamics and industry figures reveal the reasons for Android’s popularity among desi users.

- they are cheaper, found everywhere, and have special offers for the Indian market;

- the OS is open; Indian tech companies work mostly with Android;

- the top phones are manufactured locally, even if the brands are Chinese;

- social media influencers and tech reviews show mostly Android phones already in demand across India.

Google Play vs Play Store

This is also why the snowball keeps rolling in favour of existing leaders. Dominant mobile tech finds support in top-tier influencers and general public interest. Features and device usage sustain a two-sided market demand which is not expected to change in the short run. That is unless additional political, trade, or regulatory constraints are introduced on the tech and gaming scene.

Consequently, Google products and services remain the most popular in the Union. The Play Store is the top choice of desi gamers to discover new games ahead of social media updates. Besides freemium games, Google handles way more paid game app downloads than Apple’s App Store. Partly because, Google Pay and other payment providers are much better integrated with Android.

Google Pay currently holds a 40% market share. Even when (and if) the tech giant is forced to limit new customer onboarding. GPay is projected to legitimately keep a 30% share of the Indian mobile payments market.

Xiaomi, Samsung, Vivo, and OPPO Hold Solid Bases across the Union

The leading smartphone brands have had a crucial role in establishing such dominance by Android and Google in India’s gaming world. The presence of domestic manufacturing facilities is indicated as a decisive factor.

The industrial complex in Noida (Uttar Pradesh, with Delhi across the river) accommodates Xiaomi, Oppo, Realme, Oneplus, and Vivo facilities. Chinese companies have factories in Tamil Nadu and Andhra Pradesh as well. The “Make in India” initiative seems to be working in that sense. With foreign companies transferring manufacturing capacities also due to Government incentives.

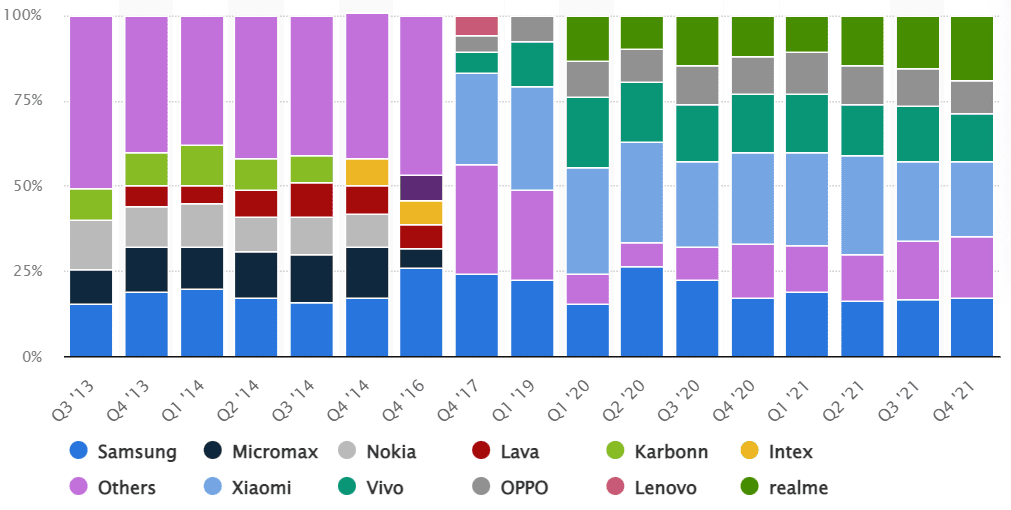

Recent sales figures across India help us confront our primary findings with industry-wide statistics. Xiaomi entered the scene strongly in 2016 and overcame Samsung only a year later, with Samsung’s market share already challenged by Vivo. At present, Realme has been the most consistent grower in the past two years.

Mobile Phone Sales across India (Q4 2021) are as follows: Xiaomi 22%; Samsung – 17.3%; Realme – 18.8%; Vivo – 13.8%; OPPO – 10.1%; others – 18%.

We can clearly see the gradual shrinking (although not critical) of Xiaomi while Realme maintains its impressive growth. Overall, Chinese-origin brands held an approximate 80% share of last year’s smartphone sales.

Traditional Desktop Computers Almost Out of the Equation

We have seen the dominance of Android in the mobile device segment. There is still a sizeable Windows used market as the system of choice for 19.77% if we include types of devices. But we know that comes from desktop computers almost exclusively.

Therefore, it is reasonable to expect SevenJackpots figures to show only 12.38% of gamers using their computers, mostly hard-core gamers. The declining importance of mid-size devices is also an important trend that is expected to continue.

Popular consoles like the Microsoft Xbox and the Sony PlayStation are considered a luxury in many households, especially by mass youth culture. Smartphone gaming is “pocket- and user-friendly” even for first-time users, lifting it to 90% on certain RMG and casual gaming platforms.

Apple More Prominent in Delhi and Tier-1 Cities

The research team expected Apple to do better in large urban areas. An industry survey had already outlined the nation’s richest cities’ influence on the gambling scene.

India’s iPhone sales in the past two years confirm some of the problems Apple faces with app support (e.g., Maps and Siri), with Apple Pay still not available because of “technical issues” with RBI regulations.

As a result, Apple remains slightly above 3 percent in year-end 2021 market share statistics. The company had a strong Q4, but it would take much effort to reach 4% in annual averages.

Apple has always had a different philosophy, to begin with. Its top-grossing games rarely include Real Money Gaming (RMG), and online casino apps are not in high demand.

More of a status symbol for desi consumers, the iPhone is popular with influencers in Delhi and Mumbai. Apple did not target a wider market over the years, with iPhone ads often limited to airports, big cities, and glitzy locations.

Apple’s first official (physical) store in India was announced for the latter part of 2021 but was delayed for mid-2022 (around Independence Day). Even the dedicated online store was launched only in late 2020. Industry experts suggest more “tailor-made” offers for the Indian market if Apple is to leave a mark.

Insights on Rural India

Out of the above-cited 810 million mobile device users, the urban-rural user ratio is reported as 55-45. An important driver of market growth, particularly in the past 3-4 years, rural internet users are closing the gap and need a deeper understanding of their mobile gaming needs.

The popularity rise of online entertainment has particularly been favoured by wide-scale mobile device adoption, even more than internet access and speed. The domestic market sees Reliance Jio Infocomm Ltd as the dominant telecommunications provider, with over 400 million subscribers, followed by Bharti Airtel placed second (350 mln), Vodafone Idea (220 mln), and BSNL (60 mln).

Rural India – Access to Platforms

Despite the best efforts, however, up to two-thirds of Indian consumers still have difficulty in getting stable access to platforms and transactions, mainly because of poor network quality. And it is not only 3G and 4G that we see widely still the norm for the desi market. There are reportedly over 350 million users that have 2G as their usual service speed. The device costs often slow nationwide transition to 4G (despite subsidies and special offers).

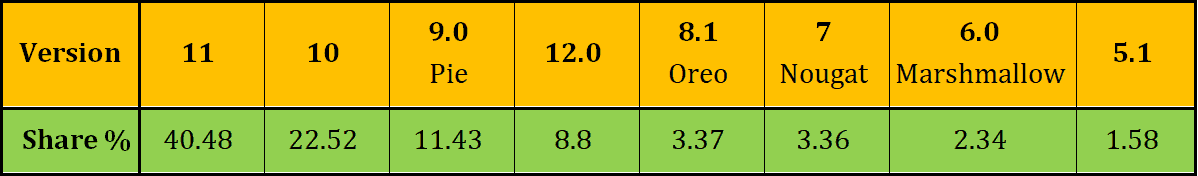

This translates into a particular market for online entertainment and gaming as well. The market tends to evolve quickly, with desi studios and foreign competitors advertising dynamic gameplay and advanced visual rendering. However, the operators should keep in mind the below data on Android versions currently in use across India.

Android 12 is currently the norm in most mature markets (launched in October 2021), with Android 13 announced to release in August 2022. Yet we see that Android 11 is keeping phones running at a decent level of upgrades, maintaining the largest share in India.

More importantly, more than 50% of all users have Android 10 and below installed on their phones, while nearly 30% have 9 or below. This affects UX and shows that many players would find it hard to fully enjoy a feature-loaded or a generally heavy app or online gambling platform.

Nevertheless, the positive perspective remains. Rural users and expanding demographics (see below for urban contexts) continue to sustain the segment growth. Middle-aged and female gamers are on the rise, and around half of all 11-year-olds in India are reported to have their own smartphones as rural families are increasingly able to provide smartphones to their kids.

The Importance of Urban Areas and Expanding Demographics

Expanding Demographics

Maharashtra’s leadership in our rankings confirms the importance of Tier-1 cities like Mumbai and Pune. Bengaluru, Hyderabad, and Chennai are also well represented, and understandably so, given their high-tech development, infrastructure, and manufacturing capacities.

Previously established profiles of Indian mobile gamers saw the typical user defined as a man between 25 and 44, constituting up to 47 percent of the nation’s players. However, we should consider the growing significance of female mobile gamers. Even those up to and over 45 years of age, especially after the series of physical distancing lockdowns.

In support of these trends, we also see the 2021 InMobi Pulse survey of Indian gaming habits, which states that 60% of mobile users between 45 and 54 years of age also play games. Women are estimated to constitute a total of 43% of the mobile gaming audience. More impressively, only 12% of female players are between 25 and 44, while 28% are over 45 years.

Expanding Demographics – Urban Markets

Redefining India’s modern gaming and gambling audience would see it recognised as gender-neutral and more mature. Gaming is competing with all entertainment genres for user attention. Together with streaming (and OTT), social networks, and short video clips. It is actually the fastest-growing segment of Media and Entertainment in India.

It is important to emphasise that India’s fast-paced urban markets catalyse these changes. The aggregate amounts of territorial and device usage data revealed by 7JP traffic lead to consistent considerations of the importance of factors like (disposable) income, internet penetration, payment provider integration, media exposure, and overall development.

Urban Areas

We have seen similar rankings for at least a couple of years on our casino review platforms, with the top 10 states clearly the same. Acquisition volumes and player value confirm the pronounced leadership of Maharashtra users. The weight of Tier-1 cities Mumbai and Pune pushes up the state’s visibility on the Indian online gambling scene. Bengaluru, Hyderabad, and Chennai – with various degrees of high-tech development, infrastructure, and manufacturing capacities. Also validate these factors in shaping the market.

In fact, the leading 400 gaming companies reported in 2020 by Maple Capital Advisors were almost all located in and around these metropolitan areas. Many might have had the experience of providing tech support to foreign enterprises. Still, a growing number were also fresh on the market, boasting sufficient know-how and broad horizons ahead.

Now in the thousands, these gaming development studios produce content that serves a new generation of players. The industry needs to provide more localised content and more genuine desi favourites in terms of genres, themes, graphics, and language support. Urban consumption may be more globalised. However, it still has firm roots in traditional Indian culture. That is especially true for classic RMGs like Teen Patti and Andar Bahar.

Urban Areas – Top Gaming Apps

High-quality native content is stably in the top 5 casino gaming apps by downloads, with Teen Patti and Rummy standing tall above the rest. But prominent Indian tech companies have carved their domestic market and established an important global presence. Desi gaming giants include Nazara (multi-genre), fantasy sports leaders Mobile Premier League and Dream11, Reliance JioGames, Paytm First Games, Games 24×7, and Tiger Global.

Ultimately, however, the Indian consumer remains on the lookout for more value for money despite the defining powers of metropolitan gamers. This is true for hardware (devices) and software (game monetisation types). The majority of mobile devices are sold in the range between USD 50 and USD 200. The listed brands of Android smartphones dominate the market because of the numerous offers in that category. Something Apple does not intend and cannot afford to pursue.